The Hidden Risks in Contracts: What Most Businesses Overlook

In the dynamic landscape of commercial agreements, contracts are often perceived as administrative formalities - signed, filed, and forgotten. However, beneath their surface lie latent risks that can erode value, introduce liabilities and lead to costly disputes.

This blog explores five frequently overlooked contractual risks and outlines practical measures to mitigate them.

1. Ambiguity: A Catalyst for Disputes

Phrases such as “best efforts”, “as soon as possible”, or “timely manner” may appear innocuous, yet their subjectivity can result in different interpretations. While one party may consider two days to be timely, another may interpret this as eight.

Ambiguities such as these often arise from the uncritical use of template clauses. In the event of a dispute, vague language can become a focal point of contention. Precision in drafting is not merely best practice; it is a fundamental safeguard against litigation.

2. Outdated Clauses: Legacy Terms in a Modern Context

References to superseded regulations, technologies, or business models can create compliance vulnerabilities. For example, data protection clauses drafted prior to the introduction of GDPR or Brexit may no longer meet current legal standards. Similarly, Service Level Agreements (SLAs) based on legacy systems may misrepresent present-day capabilities.

Routine contract reviews are essential to ensure that terms remain relevant, enforceable, and aligned with the prevailing legal and operational environment.

3. Hidden Liabilities: Unseen Obligations

Indemnities, warranties and limitation of liability clauses often carry obligations that are not immediately obvious. A broadly worded indemnity might require coverage for losses beyond your control. Silent renewal clauses can lock businesses into long-term commitments without renegotiation.

Understanding both the explicit and implied liabilities within a contract is critical. It’s not just about what is written, it’s about what it means in practice.

4. Imbalanced Risk Allocation: Negotiation Is Not Just About Price

Small Medium Enterprises (SMEs) frequently accept one-sided terms due to time-pressure, minimal contractual expertise, lack of perceived leverage or simply a desire to get the deal done. Clauses including unlimited liability, unilateral termination rights, or restrictive non-competes can severely constrain operational flexibility.

Negotiation is a strategic tool, not just for pricing, but for protecting business interests. Even in asymmetrical relationships, there is scope to challenge unfair terms and seek a more balanced outcome.

5. Missing Exit Strategies: Planning for the Worst

Contracts should always include a clear exit path, whether through contractual end dates, termination clauses, force majeure provisions, or dispute resolution mechanisms. Without these, businesses risk prolonged disputes, reputational damage and financial loss.

A well-structured exit strategy is not pessimism, it is preparation.

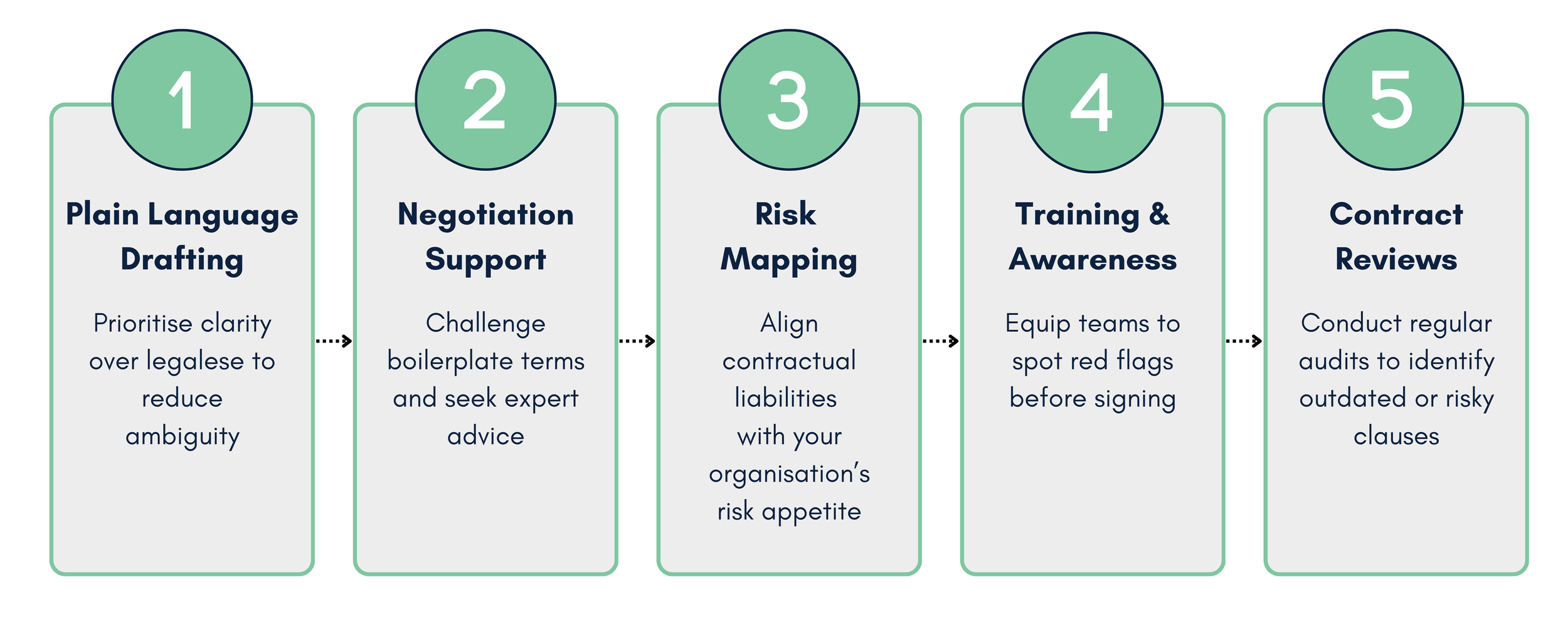

Mitigating Contractual Risk: Five Practical Steps

Contracts are more than legal instruments, they’re strategic enablers. By identifying and addressing hidden risks early, businesses can both protect their interests and strengthen partnerships.

At Deecon Consulting, we support our clients in developing accurate and detailed contractual documentation tailored to their business needs. From the full NEC suite to bespoke contract types, our team ensures that agreements are robust, relevant, and strategically aligned. Whether drafting from scratch or refining existing terms, we help organisations mitigate risk and strengthen commercial resilience.

Words by Elif Beste Gul

Edited by Anna Pringle