Tackling the UK Construction Labour Shortage

HS2. Crossrail. Thames Tideway. Hinkley Point C. Fibre roll-out. Stonehenge tunnel.

These are some of the largest infrastructure projects set to hit the UK in 2022, which aim to pull the construction sector back to pre-COVID production levels.

In September 2021, the government set out their National Infrastructure and Construction Pipeline, confirming plans for a £650 billion investment over the next decade to support 425,000 jobs a year over the next four years [1]. This investment aims to accelerate the delivery of planned infrastructure projects and programmes. However, the current shortage of labour in the construction sector poses an enormous challenge to meeting these targets, with increased investment perhaps only highlighting the problem.

What Is The Impact?

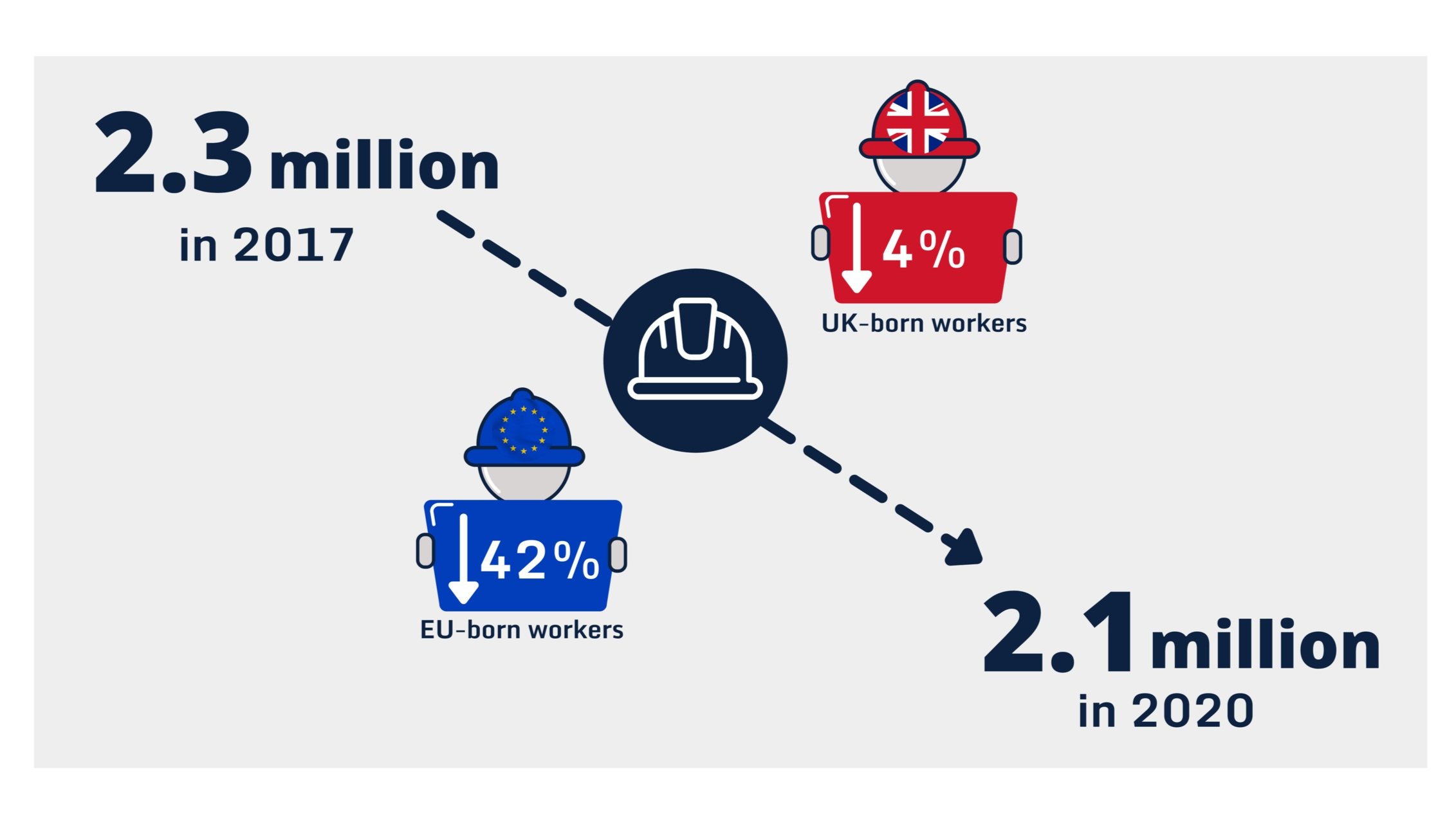

The rush to reopen society, combined with the exodus of European workers that has occurred during the pandemic, has led the UK to experience one of its worst labour shortages in 25 years [2]. A Randstad survey found the number of vacancies in the construction sector increased by 39% in the first half of 2021 compared to 2020, while the number of applications fell by 23%. This represents a 4% decline in UK-born workers, but a much more significant 42% fall in EU workers [3].

Figure 1: Construction employment, Source: ONS

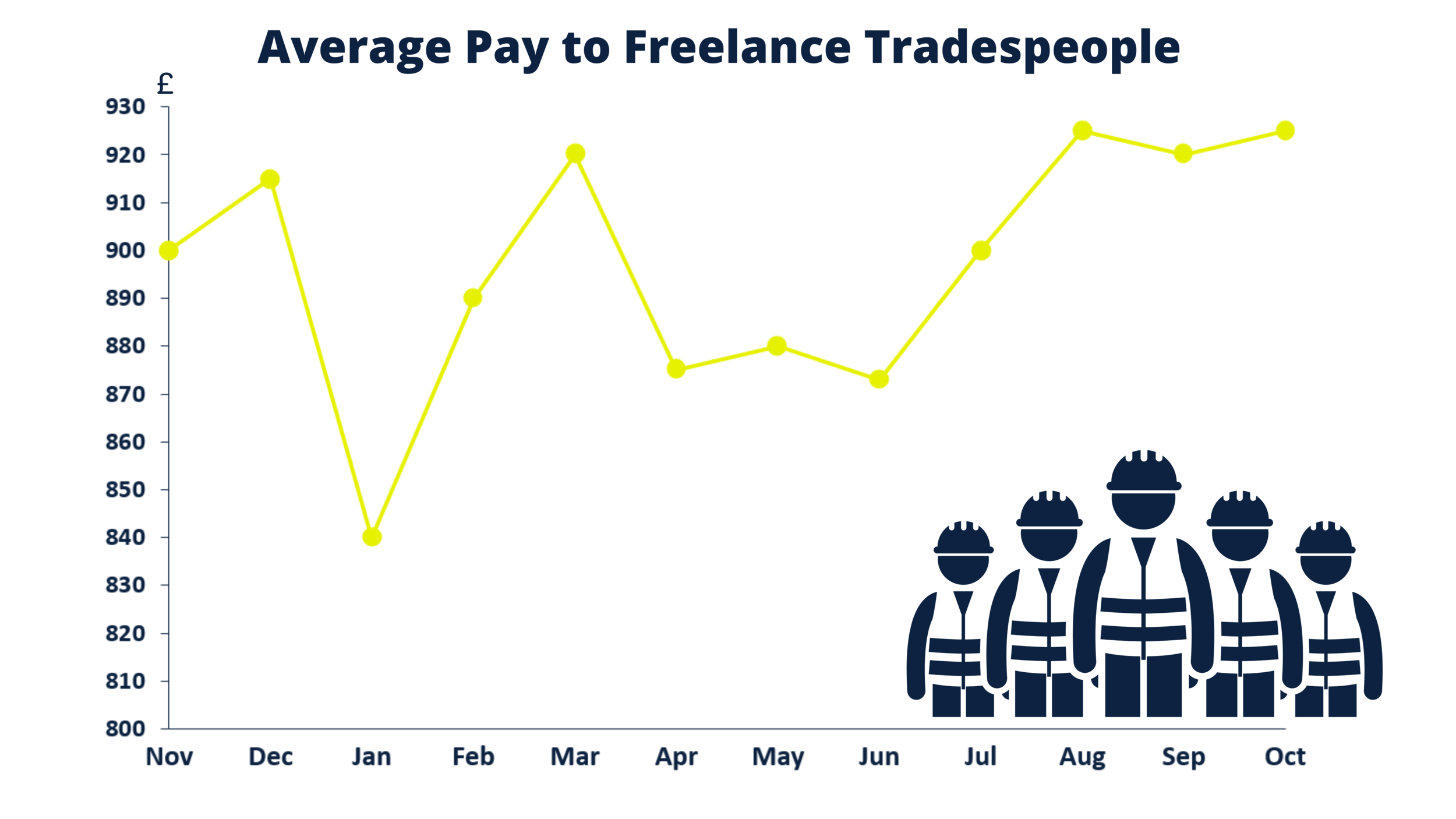

The issue runs deeper than just a general labour shortage; it is skilled labour specifically that is lacking across many industries. From hospitality to social care, many are feeling the pinch. As employees feel increasingly empowered to jump from company to company based on location preferences, job benefits, and work flexibility, employers are having to work increasingly hard to maintain staff levels. Client organisations are forking out 14% more on average for construction workers compared to the first half of 2020 according to Randstad [3]. Figure 2 below shows the increase in pay to the average tradesperson in Jan 2021, rising by 11.5% in October 2021 from a low in January [4]. Combined with the construction material costs hitting a 40-year high [5], price increases are trickling down to consumers. End-users are seeing an immediate surge in house prices, with more indirect costs likely to follow, as public and private organisations recoup their costs from the major infrastructure schemes in operation.

Figure 2: Average weekly pay to freelance tradespeople: Nov 2020 – Oct 2021, Source: Hudson Contract

And The Reason?

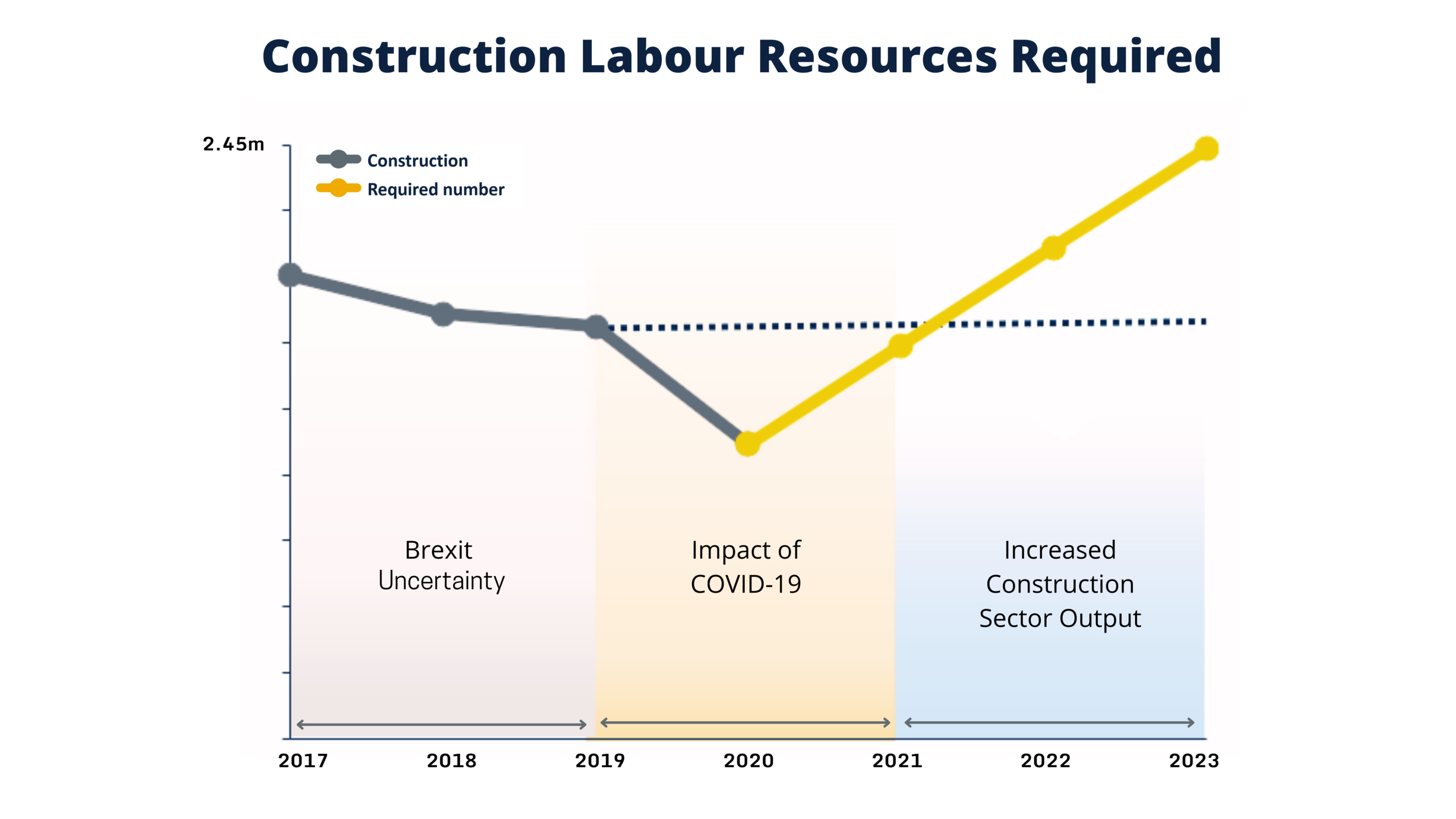

With the labour shortage affecting everyone from client organisations to consumers, it is easy to assign blame to recent economic events. However, there has been a decline of workers in the construction industry dating back to 2017 [3]. In other words, the pandemic and Brexit have exacerbated an already pressing issue. With an ageing population of trade professionals and apprenticeship schemes only receiving government incentives in the last 5 years, there is no doubt the UK is battling a shortage [6].

Playing catch-up on projects due to pandemic related delays is putting immense pressure on the construction industry to recruit, retrain and retain labour resources. Figure 3 shows the unsurprisingly steep dip in resources during the pandemic, as production slowed and lower-skilled labour moved to undertake more lucrative roles, such as delivery driving. However, given the increase in forecasted infrastructure schemes over the next two years, there will be a significant increase in the people required to fulfil these schemes even when resource numbers return to pre-pandemic levels.

It is not just the construction resource pool that is being affected by Brexit, but society more widely. A lack of available EU workers contributed to the HGV drivers shortage at the end of 2021, negatively impacting many sectors as the UK was left bereft of petrol and more [7] – something discussed in more depth in the Deecon-struct article on learning from the supply chain crisis.

Major concerns persist about further labour shortages in 2022. The UK government’s allowance for 30,000 visas to be issued for this year with the potential for an additional 10,000 to be added, is not enough to cover the deficit [8]. The importance of training centres, apprenticeships and business attractiveness has never been more important.

Figure 3: Number of resources in the construction sector up to 2021 and estimated required number, Source: ONS

Is There a Solution?

So how to solve the labour market conundrum? The challenges that the construction industry is facing do not have a quick fix. With skilled individuals having the pick of the crop, organisations must consider new strategic moves if they are going to ensure project delivery. Whether it’s investing in joint training schemes or maintaining regular lines of communication, undertaking a collaborative approach to tackle the labour shortage by working closely with your supply chain partners is one way to help ease the problem.

The significance of sustainable procurement is also a key factor to consider when kicking off these infrastructure projects. Underbidding to win projects is not likely to end well with labour and material costs still on the rise. While finding opportunities to raise wages is important, leaders should look to offer job quality factors such as security, flexibility and progression, all of which are increasingly important to a new generation of tradespeople [9].